Latest Property News

- Details

- Hits: 44

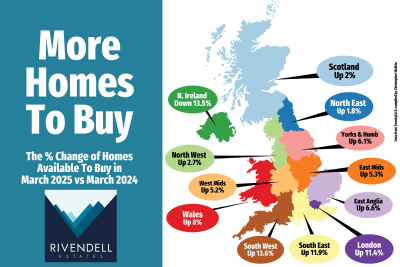

More Homes For Sale Than A Year Ago - Good news for Frome homebuyers!

There are more homes available to buy across the UK this March compared to last year – offering greater choice and opportunity for those looking to make a move in 2025.

Here’s how the increase in homes for sale stacks up by region:

- Details

- Hits: 40

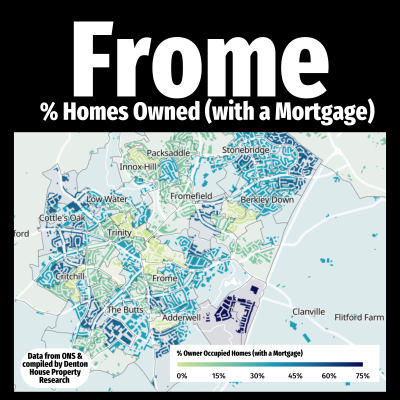

Frome: Homes Owned with a Mortgage – A Localised Snapshot

This visual map of Frome highlights the varying proportions of homes in different parts of the town that are owned with a mortgage or loan. The darker the shade, the higher the percentage of homeowners in that area still repaying a mortgage. Conversely, the greener areas indicate a lower proportion of homes without a mortgage.

It’s important to note that just because an area is green, it doesn’t necessarily mean most residents own their homes outright. These areas may have a higher number of social rented properties (typically owned by housing associations or the local authority), or a significant presence of private rental accommodation. Some of these homes may indeed be owned outright, particularly by older residents who’ve paid off their mortgage.

- Details

- Hits: 81

Frome Q1 2025 Property Market Report

Understanding what is really going on in the Frome property market is key to cutting through the noise and seeing the true picture–both locally and nationally. Despite the near constant doom and gloom headlines predicting a housing crash since September 2022, the statistics tell a very different story. The British property market–and Frome in particular–is holding up remarkably well.

So, let’s investigate those property market stats, starting with the life blood of the housing market – new properties coming on to the market.

- Details

- Hits: 58

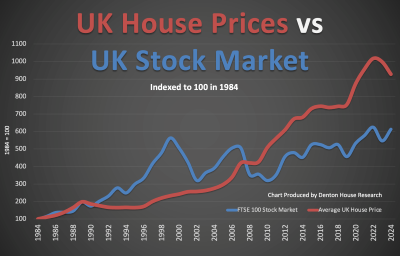

Riding the Waves: What the Latest Stock Market Wobble Means for UK House Prices

With the recent stock market dip sparked by Trump’s new tariffs and fears of a trade war, it’s understandable that some are feeling jittery. Blue-chip indices have taken a hit, and headlines are screaming uncertainty — but when it comes to the UK property market, history tells a more reassuring story.

- Details

- Hits: 73

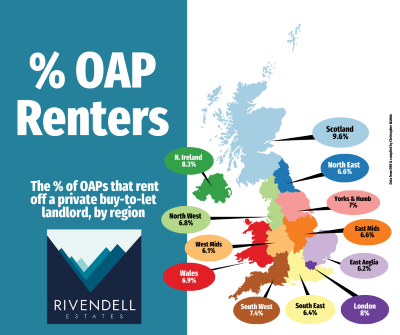

Why Are So Many Pensioners Renting?

It might surprise you to learn that between 1 in 16 and 1 in 10 pensioners across the UK now privately rent their home from a buy-to-let landlord. That’s right—not from the council or a housing association, but from the private rental sector.

This isn't just a London or city-based trend either. Scotland tops the charts with 9.6% of OAPs renting privately, while even in the quieter corners of the country, the figures remain steady. Take a closer look at the map, and you’ll see this is a nationwide shift—one that’s catching many people in places like Frome off guard.